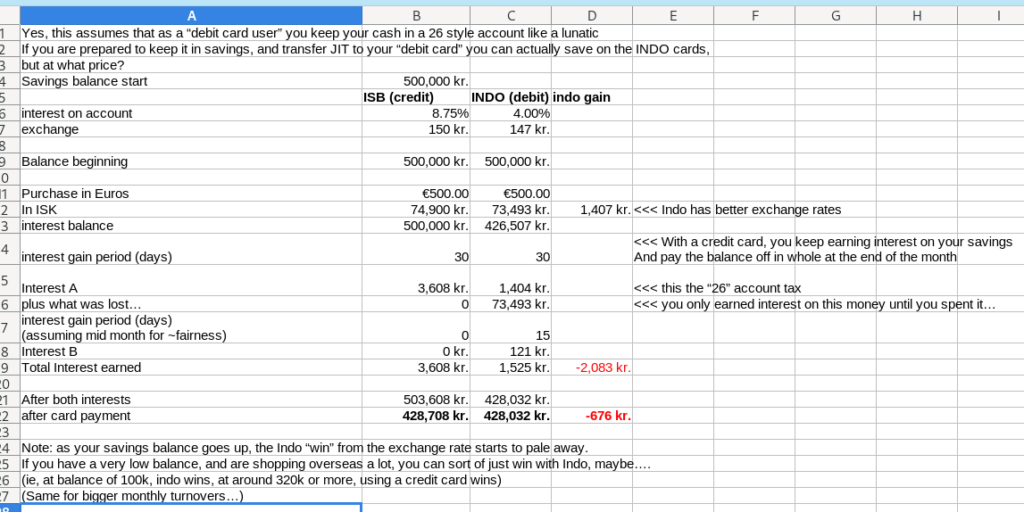

Just treat it like your own money, not “credit”. Doing all your general monthly transactions on a credit card means you continue to earn interest on your entire savings balance for the whole month. You then pay off the month’s bill, and round you go again. With a debit card, as soon as you make the payment, the money is gone, and you stop earning interest on it. Worse, your debit card accounts, so called classic “26” accounts in Iceland, pay, traditionally, abyssmal rates. Indo promises 4% on your debit card account, which is, great, but it’s still a debit card account.

ISB and others (including INDO!) have savings accounts, that pay (at the time of writing) of the order of 8% or so interest. This is substantial. By leaving your money in your savings account for the whole month, and paying off an interest free credit card statement once, you earn far less.

The spreadsheet below was particularly targetting one of Indo’s big claims, about cheaper fees overseas. And they’re absolutely right! Except it’s still a debit card, so it doesn’t matter in the end, and even that gain is irrelevant if you’re shopping in Iceland.

So, I’m glad Indo exists, making some waves, but until they offer a credit card, they’re simply not relevant.